Swisse team reassembles for Hydralyte float, IPO underway

Anthony Macdonald, Yolanda Redrup and Kanika Sood

Oct 20, 2021 – 9.34pm

Bankers are hoping investors will be thirsty for this deal.

The North American arm of hydration solutions company Hydralyte – owned and operated by a gang of former Swiss executives – is kicking off an institutional roadshow for its initial public offering, raising $17 million at a proposed issue price of 29¢.

Hydralyte’s hydration products are used by athletes to replace electrolytes lost through sweat.

The company, which makes electrolyte-rich tablets, liquids and powders, expects to lodge a prospectus with the ASX on November 3, and has told investors it plans to go public on December 9 with a $47 million market capitalisation and $25.9 million enterprise value.

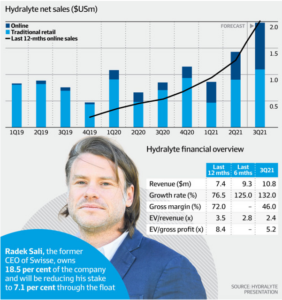

Led by former Swisse Wellness North American general manager Oliver Baker, Hydralyte also counts former Swisse Wellness director of strategy and corporate George Livery as its chairman, while former Swisse CEO Radek Sali owns 18.5 per cent of the company.

Sali is the group’s second biggest shareholder, behind founder Dan O’Brien, who has 23.5 per cent. Sali will reduce his stake to 7.1 per cent through the IPO, while O’Brien will hold 9.2 per cent.

Phil King’s Regal Funds is also on the register via its emerging companies opportunities fund and will have a 5.8 per cent stake after the float.

Just the American branch of Hydralyte is being listed, with the Australian division sold to Prestige Brands in 2014, under its local subsidiary Care Pharmaceuticals.

Hydralyte, which has stockbroker BW Equities handling the raising, will use IPO proceeds to invest in marketing, product development and pay for operating expenses.

A deck sent to investors, seen by Street Talk, revealed that based on third quarter sales, it had a full-year revenue run rate of $10.8 million. Actual revenue for the 12 months to September 31 was around $7.5 million.

Bankers pointed to the likes of Candy Club, Forbidden Foods and Pure Foods as comparable businesses. These companies trade on enterprise value to revenue multiples of 3.1 times, 2.6 times and 4.3 times respectively.

Hydralyte believes future growth will come via scaling its brands through more distribution channels, forming social media partnerships with influencers, geographic expansion into markets like China, creating more products and via acquisitions or strategic partnerships.

It wants to lower its costs of customer acquisition, spending the bulk of its marketing dollars with Amazon and rebuilding its website.

Bankers are selling prospective investors on the company’s position at the intersection of three large consumer markets, which are all experiencing growth – health and wellness, low sugar beverages and increased consumption of vitamins and minerals.

The company sells directly through its website, plus third-party ecommerce platforms like Amazon, as well as physical retailers.